Peloton revealed earlier today that it wants to sell an additional $1 billion of its Class A Common shares to ramp up cash flow amid slowing momentum for its products

Peloton’s

latest financial move comes after a wider-than-expected loss in fiscal Q1

earlier this month, when it also slashed the full-year revenue outlook by $1

billion. The money shortage is a consequence of its investments into marketing,

launching new products and bolstering its supply chain. From analysts and

investors’ perspective, the investments might have been ill-timed.

The exercise equipment & media company is expected to

grant the underwriters of its offering a 30-day option to purchase up to

another $150 million worth of shares at the public offering price. Peloton

already has interested buyers such as affiliates of Durable Capital Partners

and TCV and accounts advised by T. Rowe Price Associate.

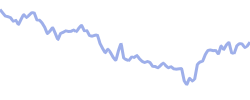

Usually, public companies pursue stock offerings to take

advantage of a growing share price, but this case does not apply to Peloton.

The company’s market value has plunged in 2021, falling almost 70% since the

beginning of the year. On Monday, November 15, Peloton closed the trading

session with shares down 3.5% after reaching a 52-week low of $46.70 apiece

earlier in the day.

Sources: cnbc.com