Investors are cautious in the premarket. Fed minutes in the spotlight

The US stocks are expected to open lower today as investors are looking for the

release of the minutes of the last Federal Reserve meeting, expecting clues on

future monetary policy. At last month’s meeting, the policymakers decided to

raise interest rates for the first time since 2018. A more aggressive approach

could be in sight to keep inflation in check. Federal Reserve Governor Lael

Brainard called for interest rate increases and rapid reductions to the Fed’s

balance sheet to bring the US’ monetary policy to a “more neutral position”

later this year.

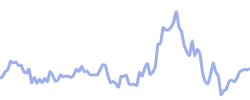

USA30

lost 0.5%, while USA500

traded 0.7% lower. TECH100

dropped 1.1%.

Oil prices edged higher today as traders are balancing

supply concerns on the back of new sanctions on Russia. Investors are fearful

of a weaker demand after the build-up in US crude inventories and an extended

COVID-19 lockdown in Shanghai. According to the American Petroleum Institute

(API) data, the crude stocks rose for the first time in three weeks – just over

1 million barrels.

US crude

oil traded 1.7% higher at $103.72 per barrel, while Brent increased 1.3% to

$108.06 a barrel.

Sources: cnbc.com, investing.com

This information prepared by ClickTrades.com is not an offer or a solicitation for the purpose of purchase or sale of any financial products referred to herein or to enter into any legal relations, nor an advice or a recommendation with respect to such financial products.

This information is prepared for general circulation. It does not have regard to the specific investment objectives, financial situation or the particular needs of any recipient.

You should independently evaluate each financial product and consider the suitability of such a financial product, by taking into account your specific investment objectives, financial situation or particular needs, and by consulting an independent financial adviser as needed, before dealing in any financial products mentioned in this document.

This information may not be published, circulated, reproduced or distributed in whole or in part to any other person without the Company’s prior written consent.

Past performance is not always indicative of likely or future performance. Any views or opinions presented are solely those of the author and do not necessarily represent those of ClickTrades.com.

Previous Article

NIO considers licensing electric car battery swap tech

Next Article

Levi Strauss beats Q1 estimates