Nielsen Holdings turned down a takeover offer from a private-equity consortium that has valued the company at $25.40 per share

According to The Wall Street Journal, the private-equity

group included Elliott Management, looking to buy the TV-rating company for

approx. $15 billion, including debt. The New York-based conglomerate rejected

the offer because it undervalues the company and doesn’t adequately compensate

its shareholders.

According to specialists, the buyout could be a relief to

Nielsen, which struggled as a public company over the years. Elliott has been

an investor in Nielsen

since 2018 and pushed the company to make changes such as hiring a new CEO,

installing several new directors, selling assets, and authorizing a $1 billion

share repurchase. Nielsen announced that it intends to begin the buyback

program.

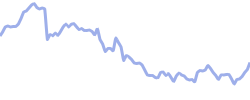

The market reacted negatively to the news, with Nielsen

stock price trading 17.59% lower.

Sources: barrons.com, Bloomberg.com

This information prepared by ClickTrades.com is not an offer or a solicitation for the purpose of purchase or sale of any financial products referred to herein or to enter into any legal relations, nor an advice or a recommendation with respect to such financial products.

This information is prepared for general circulation. It does not have regard to the specific investment objectives, financial situation or the particular needs of any recipient.

You should independently evaluate each financial product and consider the suitability of such a financial product, by taking into account your specific investment objectives, financial situation or particular needs, and by consulting an independent financial adviser as needed, before dealing in any financial products mentioned in this document.

This information may not be published, circulated, reproduced or distributed in whole or in part to any other person without the Company’s prior written consent.

Past performance is not always indicative of likely or future performance. Any views or opinions presented are solely those of the author and do not necessarily represent those of ClickTrades.com.

Previous Article

Gap beats on revenue

Next Article

NIO considers licensing electric car battery swap tech