Investors are cautious in the premarket. Fed minutes in the spotlight

The US stocks are expected to open lower today as investors are looking for the

release of the minutes of the last Federal Reserve meeting, expecting clues on

future monetary policy. At last month’s meeting, the policymakers decided to

raise interest rates for the first time since 2018. A more aggressive approach

could be in sight to keep inflation in check. Federal Reserve Governor Lael

Brainard called for interest rate increases and rapid reductions to the Fed’s

balance sheet to bring the US’ monetary policy to a “more neutral position”

later this year.

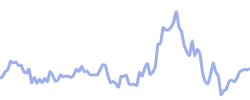

USA30

lost 0.5%, while USA500

traded 0.7% lower. TECH100

dropped 1.1%.

Oil prices edged higher today as traders are balancing

supply concerns on the back of new sanctions on Russia. Investors are fearful

of a weaker demand after the build-up in US crude inventories and an extended

COVID-19 lockdown in Shanghai. According to the American Petroleum Institute

(API) data, the crude stocks rose for the first time in three weeks – just over

1 million barrels.

US crude

oil traded 1.7% higher at $103.72 per barrel, while Brent increased 1.3% to

$108.06 a barrel.

Sources: cnbc.com, investing.com